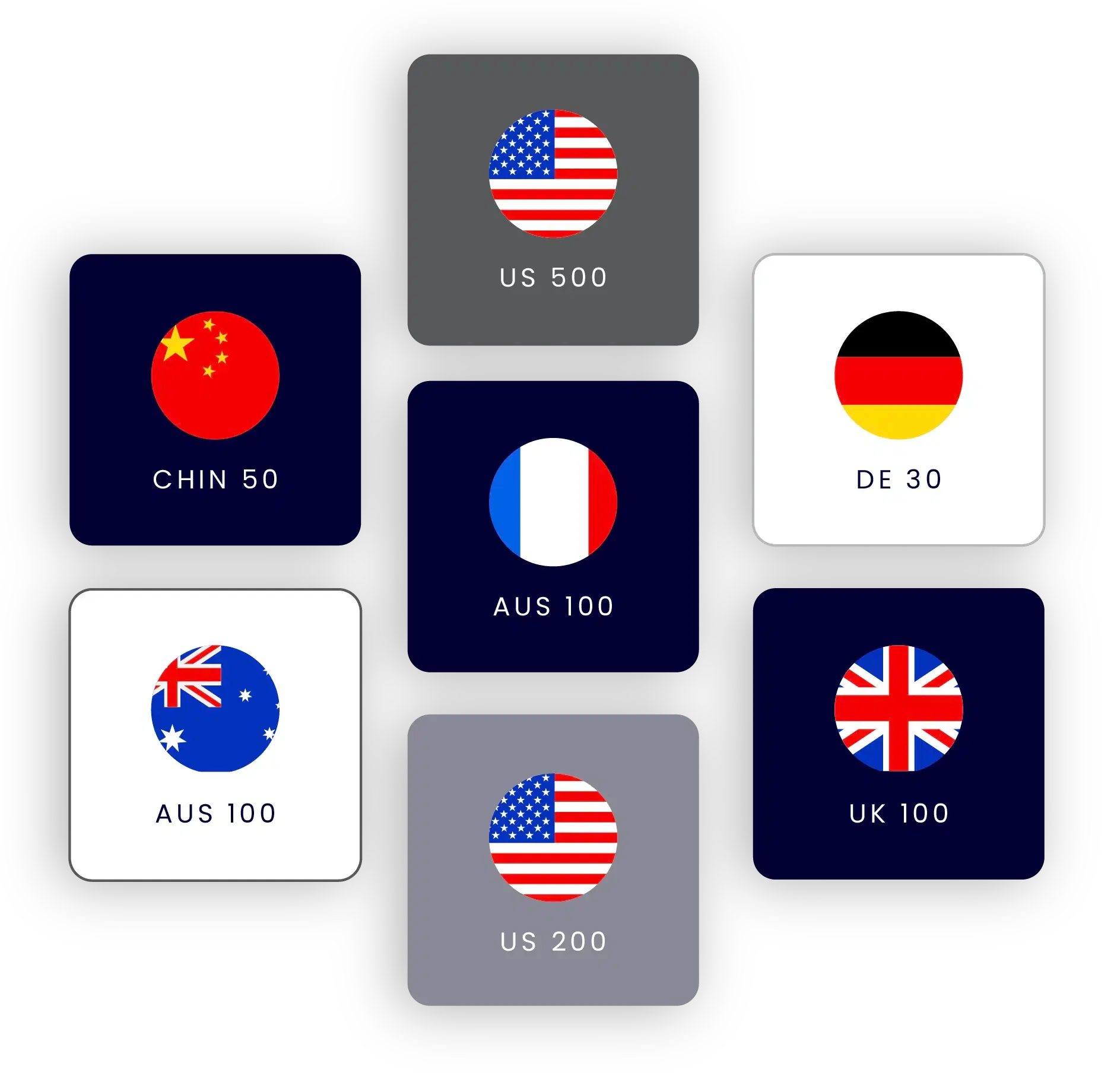

Unlock a world of profitable opportunities trading cash indices with us, offering the tools and market access for a rewarding experience

Dividend Adjustments on Cash Indices Cash Index CFDs are influenced by dividend adjustments.When an index constituent issues dividends to its shareholders, it effectively reduces the company's value by the dividend's amount. This reduction reflects in the company's share price on the ex-dividend date and subsequently impacts the index value proportionally, according to the stock's weight within the index.

To shield positions from these effects, dividend adjustments will be applied to clients' accounts who hold an index position at 00:00 (GMT+2 time zone, accounting for potential DST changes) on the ex-dividend date. The adjustment occurs prior to the market opening (check market hours above).

Dividend adjustments on long positions are credited after accounting for any relevant withholding taxes, the amount of which may vary depending on the underlying instrument. Short positions are not subject to withholding tax deductions.

It's worth noting that CFDs on Germany40 (GER40Cash) do not undergo dividend adjustments because constituent stocks' dividends are reinvested within the index itself, preventing any downward adjustments due to dividend payments.

•S&P500: introduced by Standard & Poor’s Financial Services LLC in 1957, is a leading indicator of US equities, covering about 75% of the American equity market by capitalization.•ASX200 (Australia200) is a market-capitalization weighted index of stocks listed on the Australian Securities Exchange, ranking among the world’s top 15 exchange groups with an average daily turnover of $4.685 billion.

•Nikkei 225, commonly known as Nikkei, is a stock index of the Tokyo Stock Exchange, one of the world's largest with a market capitalization of US$4.09 trillion.•Hang Seng Index (HSI): used since 1969, records the daily changes of the 50 largest companies listed on the Hong Kong Stock Market, Asia’s second largest exchange and the world’s sixth.•The FTSE 100, or Financial Times Stock Exchange 100 Index, encompasses the top 100 companies by market capitalization listed on the London Stock Exchange.•NASDAQ 100: The NASDAQ Composite is the main NASDAQ index, with the NASDAQ 100 consisting of 107 equity securities issued by the most powerful non-financial companies listed on the NASDAQ Stock Exchange.

*** The above applicable only for JLK Global Ltd, (FSCM) & JLK Global Trade Capital Co, (VFSC) Clients.

+971 800 660000

support@jinlvkang.com

393526

24/7

Risk Disclosure Statement: This website is owned and operated by JLK Global Ltd, a limited company incorporated in Mauritius (company number: C188049) and licensed by the Financial Services Commission, Mauritius (No. GB22200292) to trade as an SEC-2.1B Investment Dealer. Registered Address: Cyberati Lounge, Ground Floor, the Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. The financial services and products promoted on this website are offered by JLK Global Ltd and JLK Global Trade Capital Co. Limited, a company authorised by the Vanuatu Financial Services Commission of the Republic of Vanuatu Company license number: 40354.

JLK Global Trade Capital Co. Limited belong to the JLK Financial Group which consists of a group of entities across the globe.

Investing in derivative products carries significant risks and may not be suitable for all investors. Leveraging in these instruments can increase the level of risk and potential loss exposure. Before making any decision to engage in foreign exchange trading or CFDs, it is essential to carefully assess your investment objectives, level of experience, and risk tolerance. You should only invest funds that you can afford to lose. We strongly encourage you to educate yourself thoroughly about the associated risks and, if you have any questions, seek advice from an independent financial or tax advisor.

JLK Global Trade Capital Co. Limited do not provide services to individuals residing in specific jurisdictions and/or jurisdictions where distribution of such services would be contrary to local law or regulation.

The financial products and services offered on this website are NOT provided by the following group entities and no recourse against the following entities is available. If you are interested in the products and services offered by each of the following entity, please visit their respective websites.

JLK Group LLC-FZ is a holding company incorporated in Dubai, United Arab Emirates with Business License Number: 2311147.01. Its registered office is at: Business Center 1, M Floor, Meydan Hotel, Nad Al Sheba, Dubai, United Arab Emirates.

JLK Multi Trading DMCC is a limited company licensed and incorporated under the laws of the Dubai Multi Commodities Centre (No.DMCC-312687) and licensed by the Securities and Commodities Authority, United Arab Emirates (No.202200000007) to practice the activity of Commodity Brokerage - Trading and Clearing. Registered address: Unit No: 1501, 1 Lake Plaza, Plot No: JLT-PH2-T2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates.

Each of the entities within the JLK Financial Group is managed separately. The financial products and services offered on this website are ONLY provided by JLK Global Ltd and JLK Global Trade Capital Co. Limited.